What Is the Receivables Turnover Ratio?

The Receivables Turnover Ratio is a key financial indicator that shows how efficiently a company collects outstanding payments from its customers. It reflects how often a company successfully turns its average accounts receivable into cash within a specific period, usually over the course of a year. This ratio is crucial for evaluating a company’s cash flow and credit policies, helping businesses assess the efficiency of their credit collection processes.

Key Takeaways:

- This ratio measures a company’s effectiveness in collecting customer payments.

- A high ratio shows the company is good at collecting payments and managing cash flow.

- A low ratio can point to issues in the company’s credit collection or payment policies.

Receivables Turnover Ratio Formula: How to Calculate It

To calculate the Receivables Turnover Ratio, you need two key components:

- Net Credit Sales

- Average Accounts Receivable

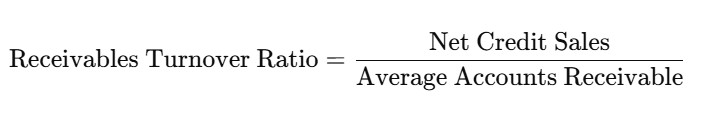

The formula is:

Let’s break down each component:

Net Credit Sales:

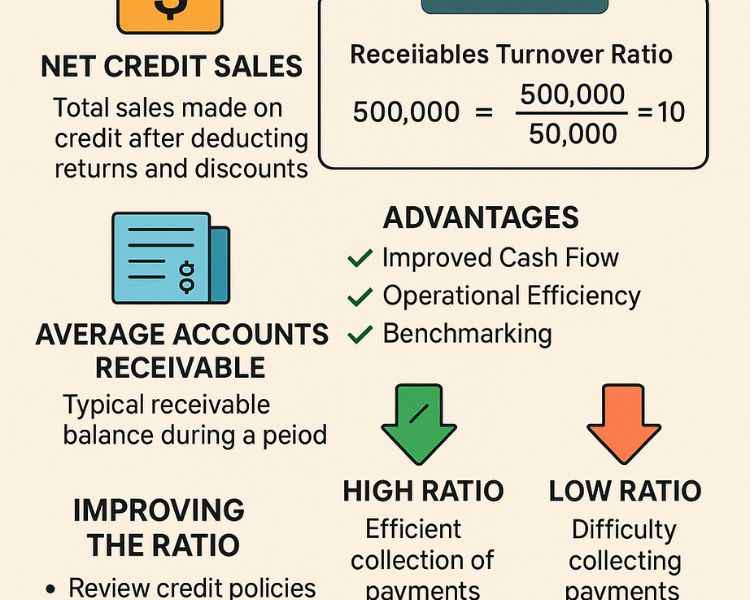

Net credit sales represent the total sales made on credit after deducting any returns and discounts. Cash sales are excluded from this figure. To determine net credit sales, simply subtract returns and discounts from the total gross credit sales during the period.

Average Accounts Receivable:

It reflects the typical accounts receivable balance a company holds over a specific time frame, offering insight into outstanding customer payments during that period. To find average accounts receivable, add the starting and ending balances, then divide by 2.

Example Calculation:

For example, if a company records $500,000 in net credit sales and maintains an average accounts receivable balance of $50,000 over the year, it can use these figures to calculate its receivables turnover ratio.

Receivables Turnover Ratio=500,000/50,000=10

This indicates the company collects its outstanding receivables 10 times annually.

Why is the Receivables Turnover Ratio Important?

The Receivables Turnover Ratio is a key indicator of how well a company is managing its accounts receivable. A higher ratio generally means that the company is collecting payments faster, improving its cash flow and reducing the risk of bad debts.

Advantages:

- Improved Cash Flow: A high ratio signifies timely collections, which supports positive cash flow.

- Operational Efficiency: Helps businesses identify how efficiently they are converting receivables into cash, which can guide improvements in credit policies.

- Benchmarking: This ratio enables businesses to evaluate their performance by comparing it to previous periods or industry benchmarks.

Disadvantages:

- Industry Variability: The ratio can vary significantly across industries, making it difficult to compare one company to another without considering industry standards.

- Seasonal Impact: For businesses with seasonal sales, it’s important to track this ratio over longer periods to avoid misleading conclusions.

- Inflated Ratios: If businesses use gross sales instead of net credit sales, the ratio may be artificially high.

What Does a High Receivables Turnover Ratio Mean?

A high receivables turnover ratio usually signals that the company is highly efficient in collecting payments from its customers. It reflects a healthy cash flow cycle, where the business is quickly converting outstanding customer payments into cash.

However, a very high ratio could also suggest that the company is overly strict with its credit terms, potentially turning away customers who might need longer payment terms.

What Does a Low Receivables Turnover Ratio Mean?

A low receivables turnover ratio suggests that a company may be facing difficulties in collecting payments or has overly lenient credit policies. This could lead to cash flow problems, as the company is waiting longer to receive payment for its goods or services.

Possible reasons for a low ratio include:

- Poor credit policies or ineffective collections.

- Late or non-payment from customers, which can result in bad debts.

- Inefficient sales or delivery processes, which delay payments.

How the Receivables Turnover Ratio Impacts Cash Flow

Understanding how the Receivables Turnover Ratio correlates with cash flow is vital. The quicker a company collects its receivables, the more cash it has on hand to support daily operations, invest back into the business, or pay down its debts. A high turnover ratio indicates that the company isn’t waiting long for its customers to pay, ensuring cash flow remains strong.

In contrast, a low ratio could mean the company has to rely more on loans or credit to maintain operations, which could lead to financial stress.

Improving the Receivables Turnover Ratio

Companies that experience a low ratio should consider the following strategies to improve their receivables turnover:

- Review Credit Policies: Tightening credit terms for new customers or offering discounts for early payments can encourage faster payments.

- Strengthen Collections: Actively follow up on overdue accounts and implement more robust collection processes.

- Offer Incentives: Reward customers who pay early or on time, improving the likelihood of prompt payments.

- Customer Screening: Perform more thorough background checks on customers before extending credit.

Receivables Turnover Ratio vs. Asset Turnover Ratio

While both the Receivables Turnover Ratio and Asset Turnover Ratio are efficiency metrics, they measure different aspects of a company’s operations. The receivables turnover ratio assesses how effectively a company collects payments from its customers, while the asset turnover ratio evaluates how efficiently a company uses its assets to generate revenue.

Both ratios are useful for assessing operational efficiency. However, the Receivables Turnover Ratio is particularly useful for understanding how well a company manages its credit and collections.

Conclusion:

The Receivables Turnover Ratio is a critical indicator for assessing a company’s financial health, particularly in terms of cash flow and credit management. By regularly calculating this ratio, businesses can track their performance, identify areas for improvement, and ensure that their credit collection practices align with their financial goals. A high ratio suggests efficiency in collecting payments, while a low ratio signals potential issues that could disrupt cash flow.

Tracking this ratio over time is essential for maintaining a strong financial position and ensuring that the business is able to meet its operational and strategic objectives.