Making smart financial decisions depends on understanding the true value of future returns. This is where the discounted cash flow model plays a crucial role in evaluating investment value.Calculating discounted cash flow reveals the true value of future returns, helping you make smarter financial decisions in investing and valuation. Whether you’re analyzing an investment opportunity, evaluating a business project, or estimating the fair value of a stock, calculating discounted cash flow can give you a powerful edge.

In this post, we’ll explain what is DCF, how it works, when to use it, and why it matters—using real examples and easy-to-understand language.

What Is Discounted Cash Flow?

DCF analysis calculates the current worth of expected future cash flows from investments or projects. The key idea is that money you receive in the future is worth less than the same amount today due to factors like inflation, uncertainty, and opportunity cost.

This concept is rooted in the time value of money, which helps investors and businesses compare the value of expected income with the cost of capital or risk involved.

Why Use a DCF Model?

The DCF model applies to various finance fields, such as assessing investments, valuing businesses, and evaluating projects.

- Investment analysis – Assess whether a project or asset will generate enough returns to justify the risk.

- Stock valuation – Determine a company’s intrinsic value to guide buy or sell decisions.

- Business acquisitions – Estimate the fair value of a target company in mergers or acquisitions.

The discounted cash flow model translates future profits into today’s dollars, helping decision-makers see the real value.

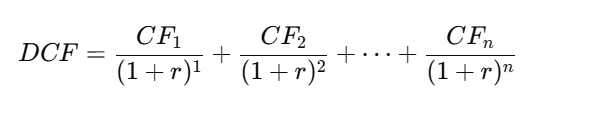

Understanding the DCF Formula

To put the DCF equation into action, you’ll need three main inputs:

- Projected annual cash flows

- Discount rate – This rate accounts for the risk and potential returns of an investment, helping estimate its true value. It’s often based on the company’s WACC (Weighted Average Cost of Capital) or adjusted for specific risks.

- Time period (number of years)

Here’s the basic DCF formula:

Where:

- CFnCF_nCFn = Cash flow in year n

- rrr = Discount rate

- nnn = Number of periods

This formula calculates the present value of each future cash inflow, allowing you to sum them and get the total investment value in today’s terms.

Discounted Cash Flow vs Net Present Value (NPV)

Though similar, discounted cash flow and net present value (NPV) have a key difference:

- DCF calculates the total present value of future cash flows.

- Net Present Value (NPV) adjusts the DCF result by deducting the initial investment amount to determine the net gain or loss.

Example:

- Total DCF: $500,000

- Initial investment: $100,000

- NPV = $500,000 – $100,000 = $400,000

Both methods are useful, but NPV offers a clearer picture of profitability.

Discounted cash flow analysis is most effective when:

When to Use Discounted Cash Flow Analysis

- Cash flows are predictable

- The investment horizon is long-term

- An accurate discount rate is available

- Objective valuation is required

It’s especially helpful for high-value projects, private business valuations, and evaluating underperforming assets with growth potential.

Risks and Limitations of the DCF Model

Although the DCF model is a valuable financial tool, it does have certain limitations and relies heavily on accurate assumptions. Its accuracy depends on your assumptions:

- Forecast risk – Overly optimistic or pessimistic cash flows can distort the result.

- Discount rate sensitivity – Even slight adjustments to the discount rate can significantly impact the estimated value.

- Market unpredictability – Economic shifts, inflation, or competitive pressure may impact cash flow accuracy.

To handle uncertainty, analysts often create different DCF scenarios, such as optimistic, pessimistic, and most likely outcomes.

Final Thoughts on Discounted Cash Flow

So, what is discounted cash flow really about? It’s a way to make future money speak today’s language.

Using the discounted cash flow formula, businesses and investors can strip out the noise and look at what truly matters: real, risk-adjusted value. While it’s not the only tool in the financial toolbox, the DCF model remains one of the most reliable methods for estimating the worth of an investment or asset.